PROJECT OVERVIEW

Payroll

Payroll is an embedded, full-service solution that enables business owners to pay their employees on FreshBooks.

-

FreshBooks is a leading accounting platform for small and medium-sized businesses. It’s a SaaS platform accessible on both desktop and mobile. 30M+ businesses in 160+ countries have used FreshBooks so far. The company was founded in 2003, and is based in Toronto, Canada.

-

Payroll

FEATURE EXPLAINED

What is FreshBooks Payroll?

Payroll gives business owners the ability to pay their team on a given pay schedule.

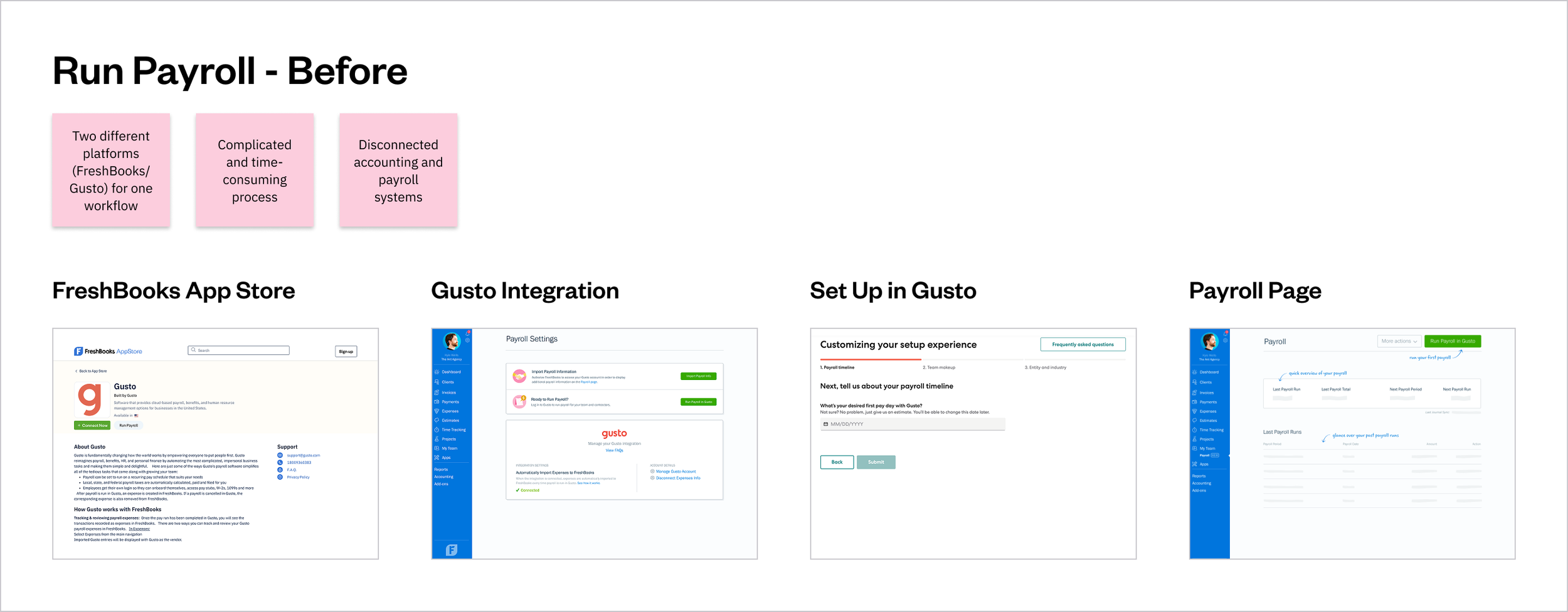

Previously, FreshBooks offered payroll exclusively through a paid add-on integration with Gusto, a leading HR and payroll provider. This integration has been available in its App Store marketplace since 2017.

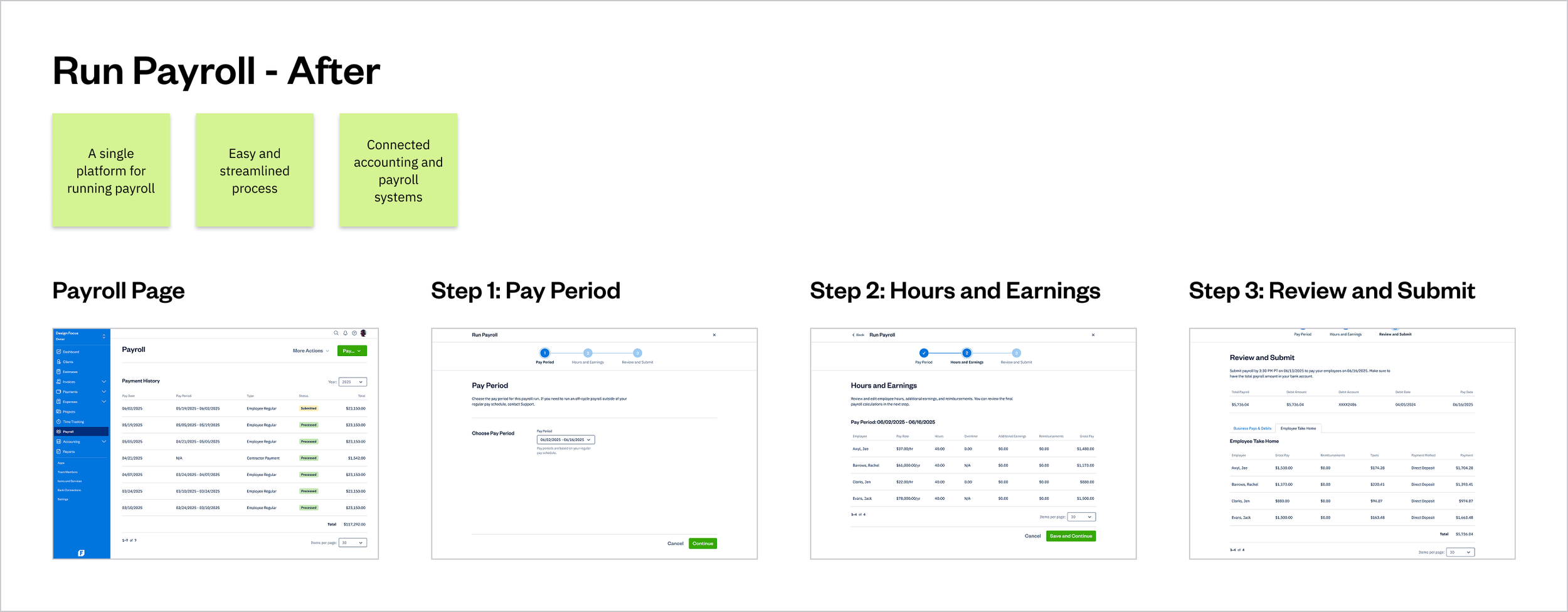

Now, FreshBooks has introduced an embedded, full-service payroll solution for U.S. customers, providing a more seamless experience.

PROBLEM DEFINITION

Running payroll is time-consuming and challenging

Customer feedback and analytics show that the integration with Gusto has caused an experience gap for business owners. This setup required business owners to operate across two different platforms, leading to a fragmented user experience.

Over time, as owners and their teams grew and scaled, their need for an embedded payroll solution increased as well.

Problems with the previous integration

One workflow split between FreshBooks and Gusto resulted in a fragmented experience

Running payroll was a complex and time-consuming process

Disconnected accounting and payroll systems

It was challenging for employers to onboard and pay their employees, prepare team hours, and get a complete picture of their finances

High lifetime churn rate (25%), with many users eventually disconnecting the Gusto integration

UX STRATEGY

UX strategy

Vision

A platform where business owners confidently serve their clients by collaborating easily with their teams and gaining insights to grow their business.

Goal

Simplify the experience for owners to painlessly organize and pay their teams so they can save time and grow their business.

Plan

Empower business owners to easily run and accurately track payroll.

DESIGN PROCESS

Design process

For this project, the team and I leveraged the Design Thinking methodology (Discovery → Ideation → Prototyping → Testing → Implementation), in order to create the best possible user experience for FreshBooks customers while aligning with the company’s strategic business goals.

Discovery

• Analytics review

• UX audit

• User interviews

• Personas

• Journey map

• Competitive analysis

Ideation

• User flows

• Wireframes

• High-fidelity design

Prototyping

• High-fidelity prototype

Testing

• Usability testing

Implementation

• Final design

• Design handoff

DISCOVERY

UX audit

I began the discovery process with a UX audit to identify issues with the experience, uncovering usability pain points and friction in the user flow caused by the previous Gusto integration.

User interviews

By applying the laddering technique during user interviews with 10 participants, I gained a deeper understanding of users’ underlying needs and motivations. Generally, most participants expressed that payroll is not their area of expertise, and they would rather have a tool handle and solve everything, because payroll is important to get right.

The sentiment was that running payroll through the integration with Gusto is a complicated process. Though they want to be “hands off” on paperwork and manual processes, owners do want to have control over payroll runs. They do not want to log into multiple systems, and want to keep things organized and simple in one platform.

Note: to protect the identities of participants, generic images/names are used here.

Journey map

I created a journey map that visualizes the previous user experience with the Gusto integration, highlighting key experience gaps, pain points, and user goals when running payroll.

Competitive analysis

Competitive analysis revealed that most competitors already provide an embedded payroll solution in their core markets, and that is clearly a direction where the market is heading.

IDEATION

User flow

Running payroll can be complex, but this user flow demonstrates how I simplified and streamlined the process.

Wireframes

While iterating, I’ve mostly explored information architecture and navigation, by reducing complexity with the goal to create a seamless experience.

TESTING

Usability testing

I conducted usability testing with 5 participants from diverse user segments, focusing on the payroll run experience in a prototype that included two tasks:

Run Payroll

Find a Payroll Run

Qualitative findings

Positive feedback

Participants described the user flows as “easier” and “smoother” compared to the previous experience, highlighting its clarity and simplicity

It met or exceeded their expectations for how payroll should work

Neutral/Negative feedback

One participant expressed a need to set custom pay period dates in Step 1 of the Run Payroll flow

One participant experienced friction understanding the payroll statuses (“Submitted” and “Processing”) on the Payroll page

Quantitative findings

The design achieved a high task success rate, with 4 out of 5 participants completing both tasks accurately and efficiently

One participant was unable to complete Task 1 after getting stuck at Step 1 of the Run Payroll flow

Satisfaction scores were high (4.6/5), indicating that participants perceived the new experience as a meaningful improvement over the previous one

Note: to protect the identities of participants, generic images/names are used here.

SOLUTION

Payroll simplified

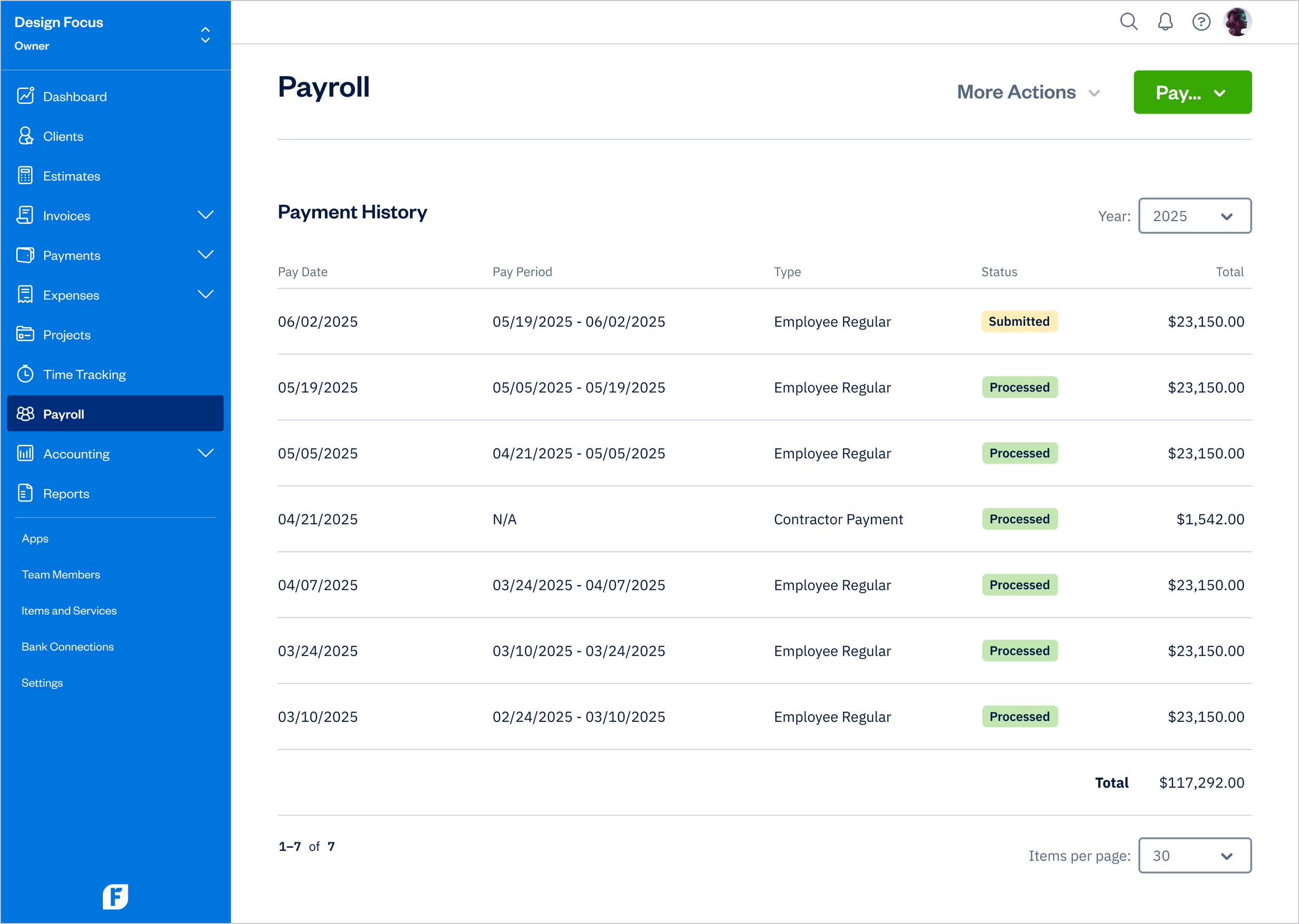

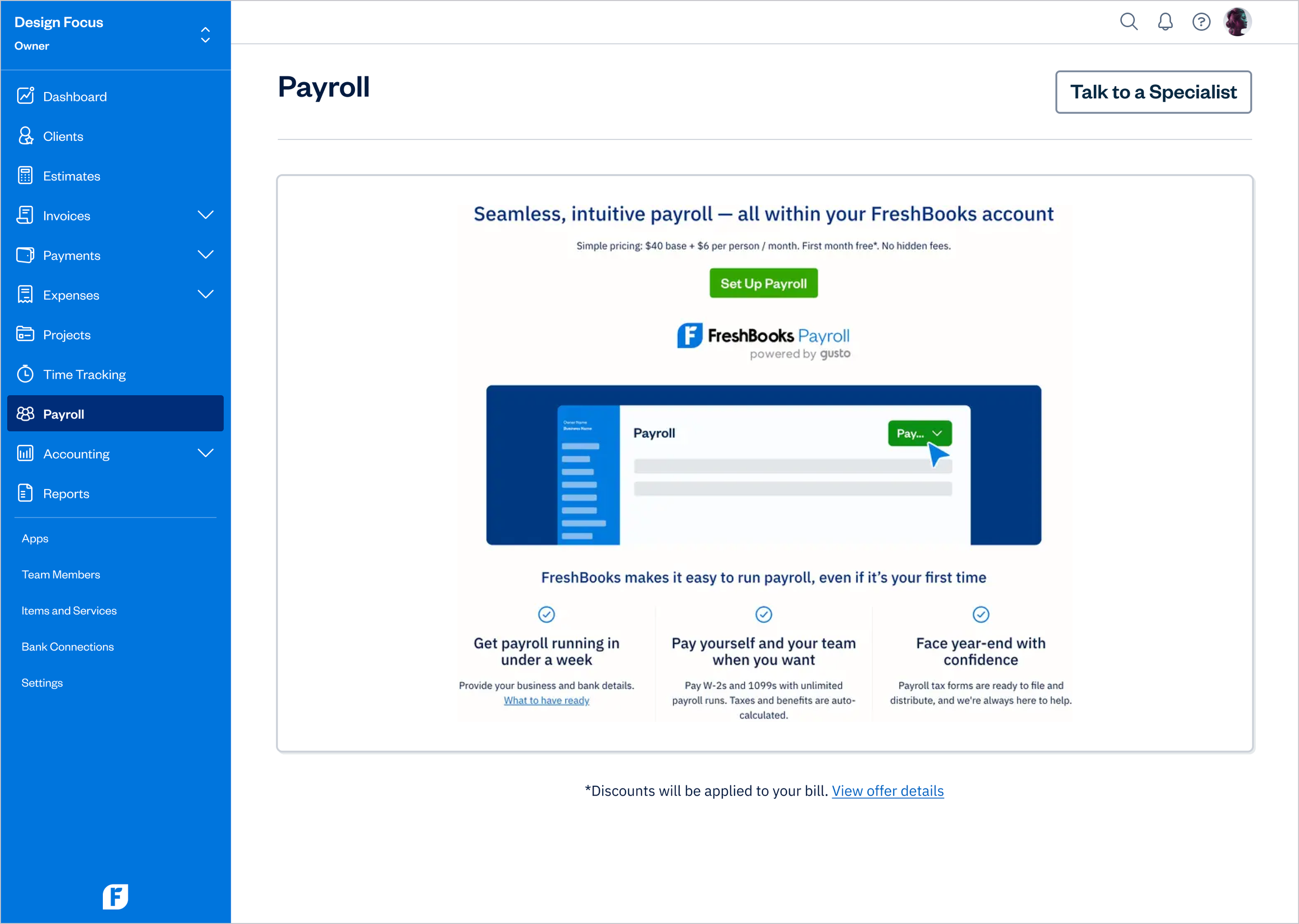

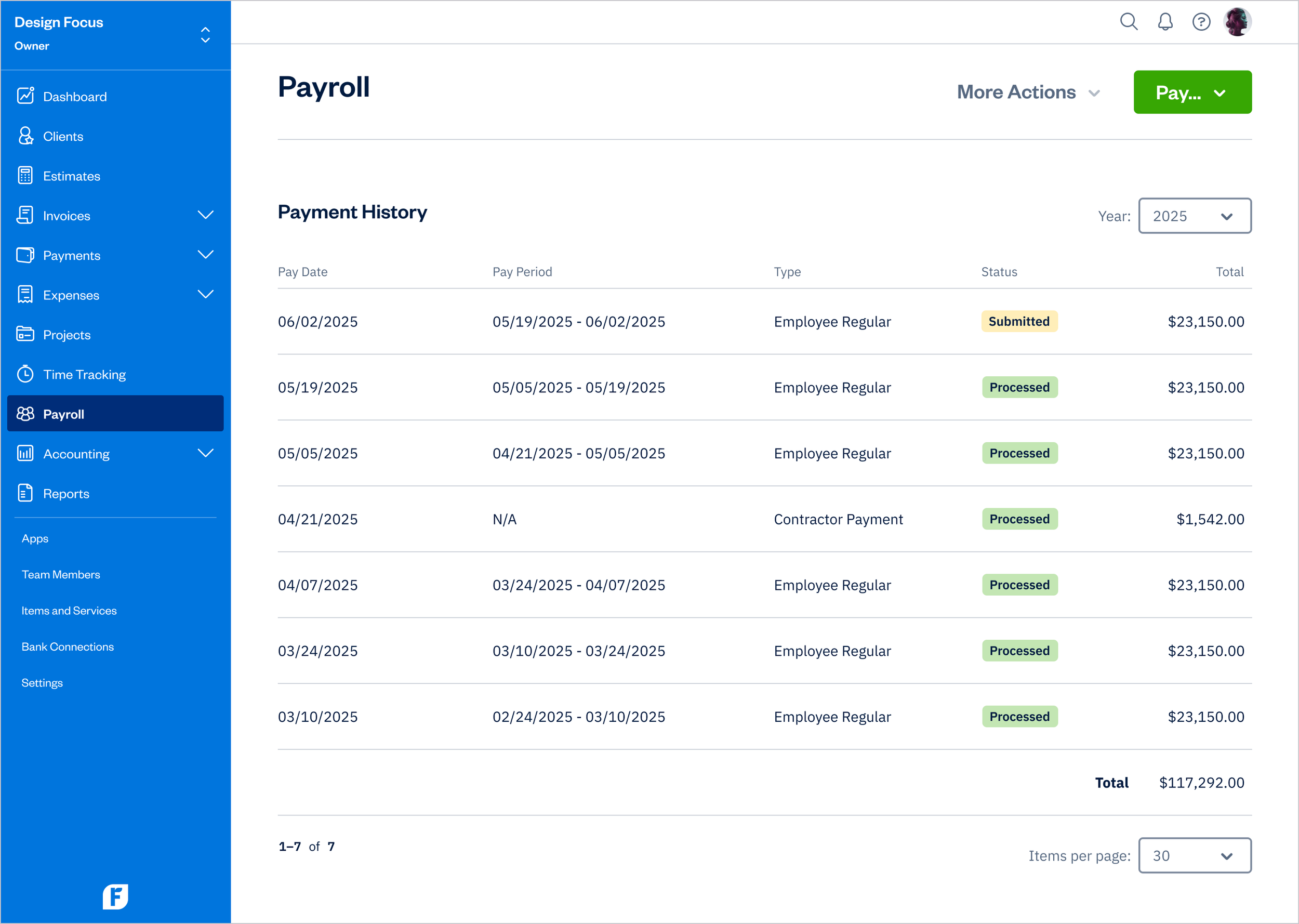

FreshBooks Payroll is a full-service payroll solution that U.S. users can add to their FreshBooks subscription, available on Lite, Plus, Premium, and Select plans (with the first month free).

Business owners have the ability to access unlimited payroll runs, automatic payroll tax filing and payments, direct deposit, and tax forms like W-2s. Plus, transactions for every pay run are automatically tracked so their reports and books stay accurate and organized.

To ensure that FreshBooks is payroll compliant every step of the way, Gusto’s back-end services are leveraged with the use of their API.

Improvements

A single platform for running payroll

An easy and streamlined process

Connected accounting and payroll systems

It’s now much easier for owners to onboard and pay their employees, prepare team hours, and get a complete picture of their finances

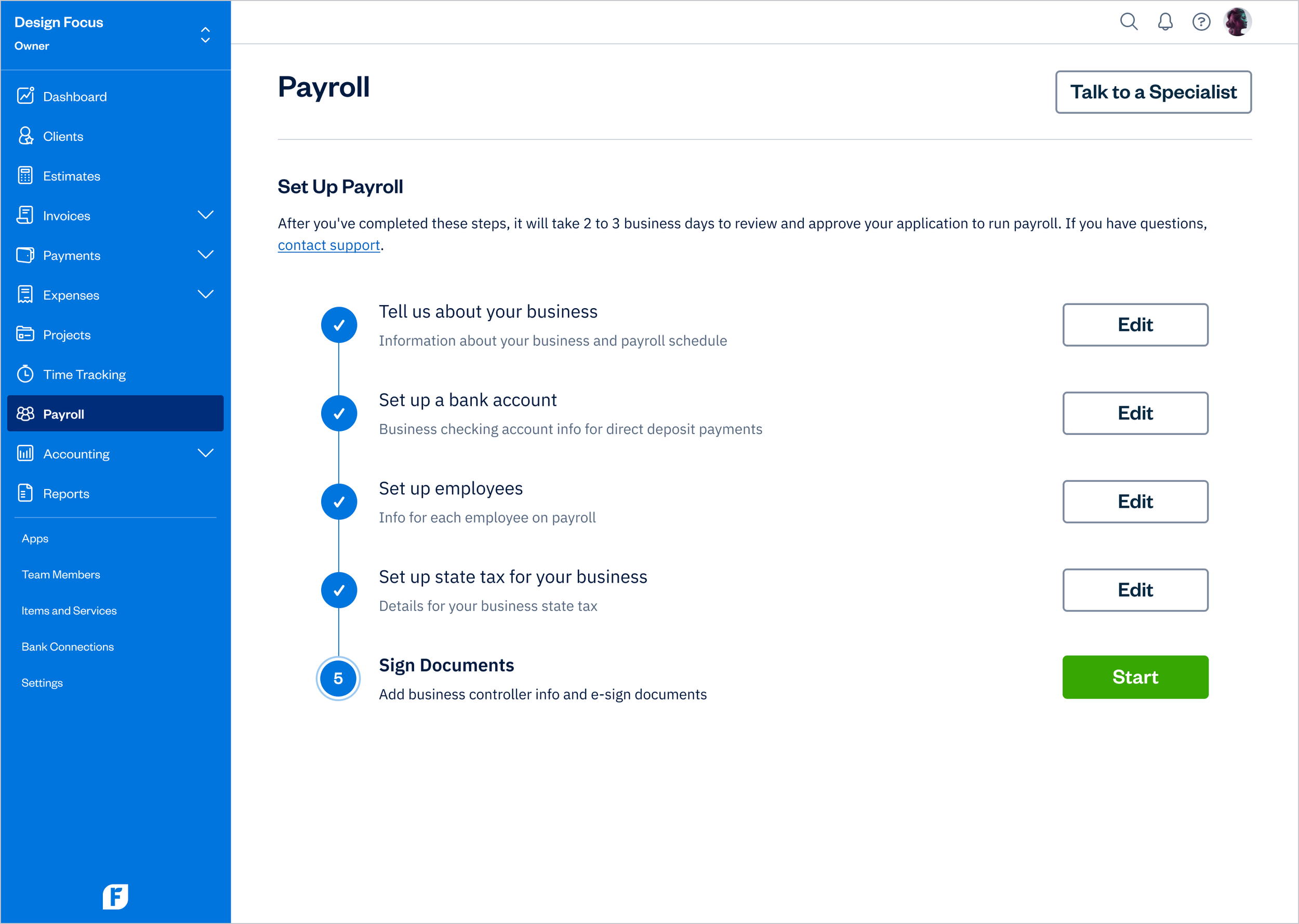

Set up

On the Payroll page, select Set Up Payroll

Add details about the business: business structure, location, and payroll schedule

Set up a bank account

Set up employees

Set up state tax for the business

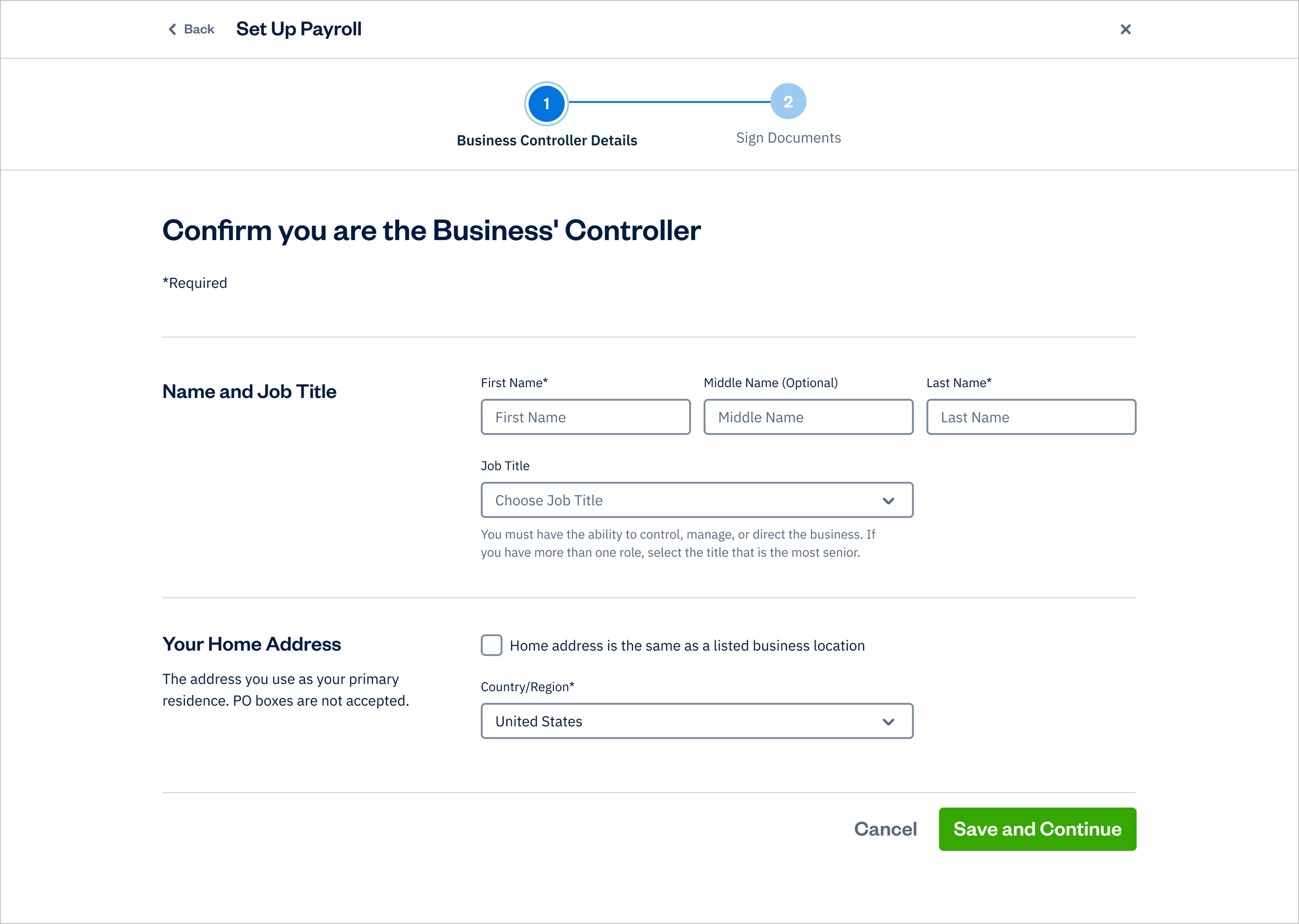

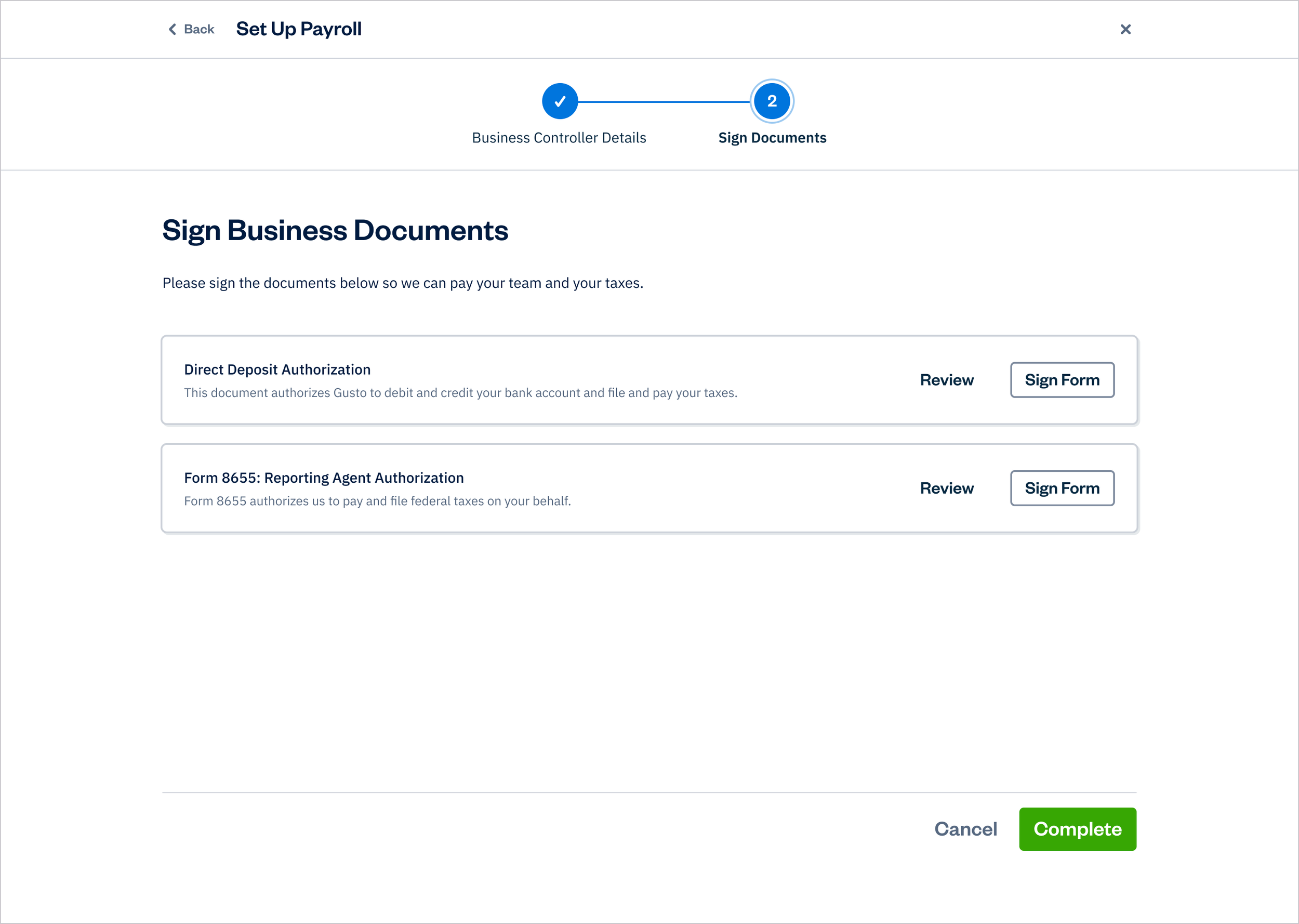

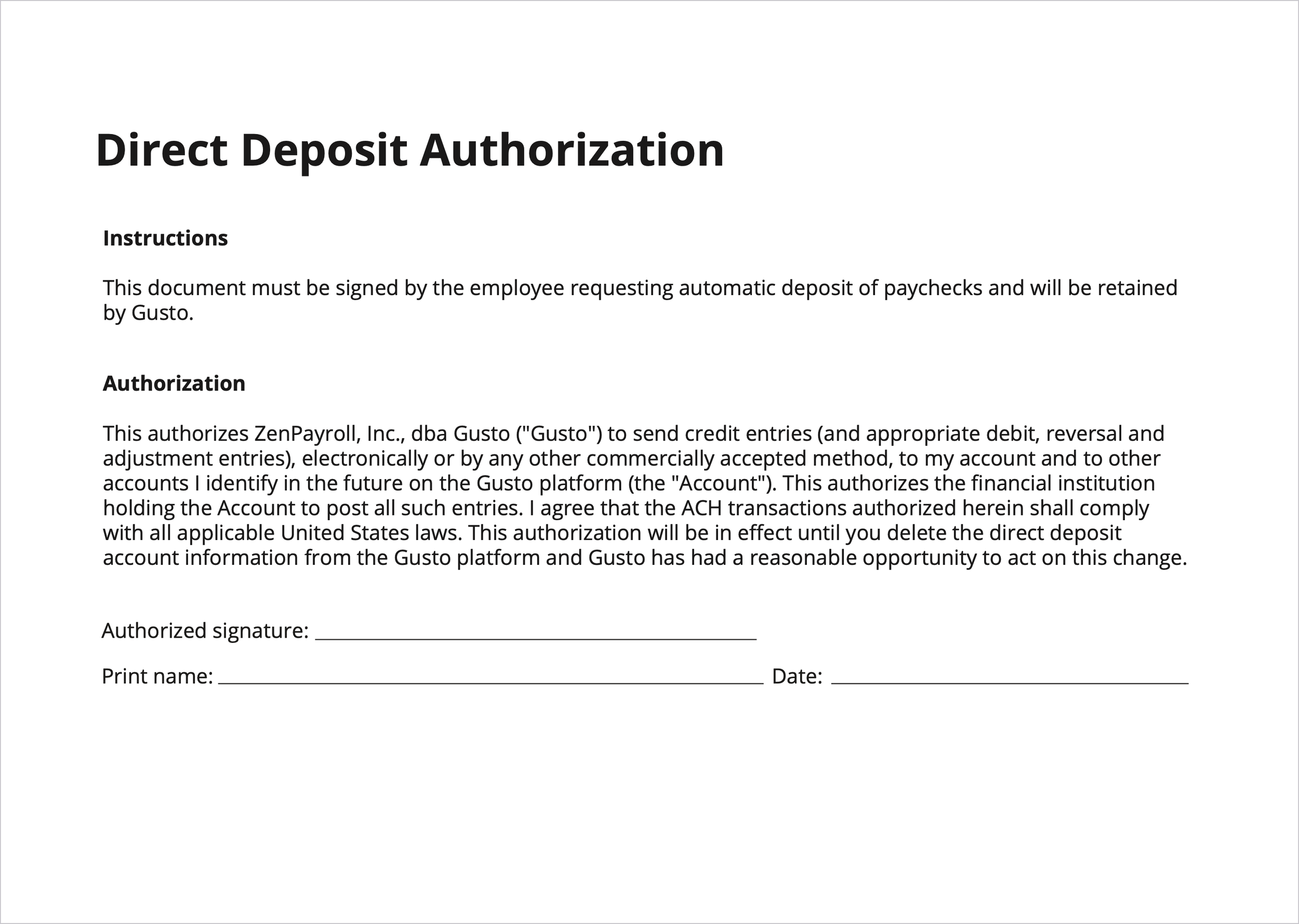

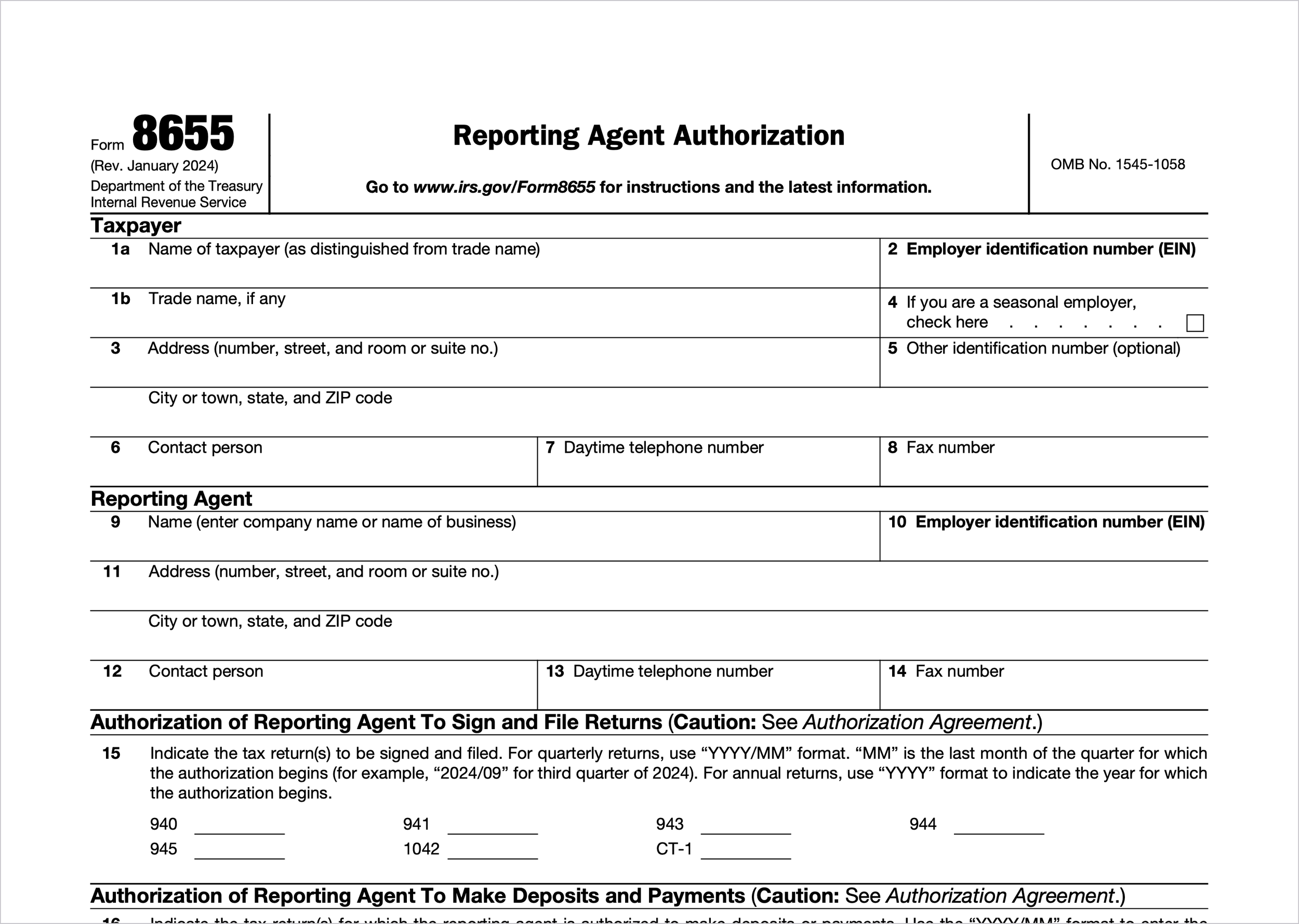

Sign documents (Direct Deposit Authorization, Form 8655)

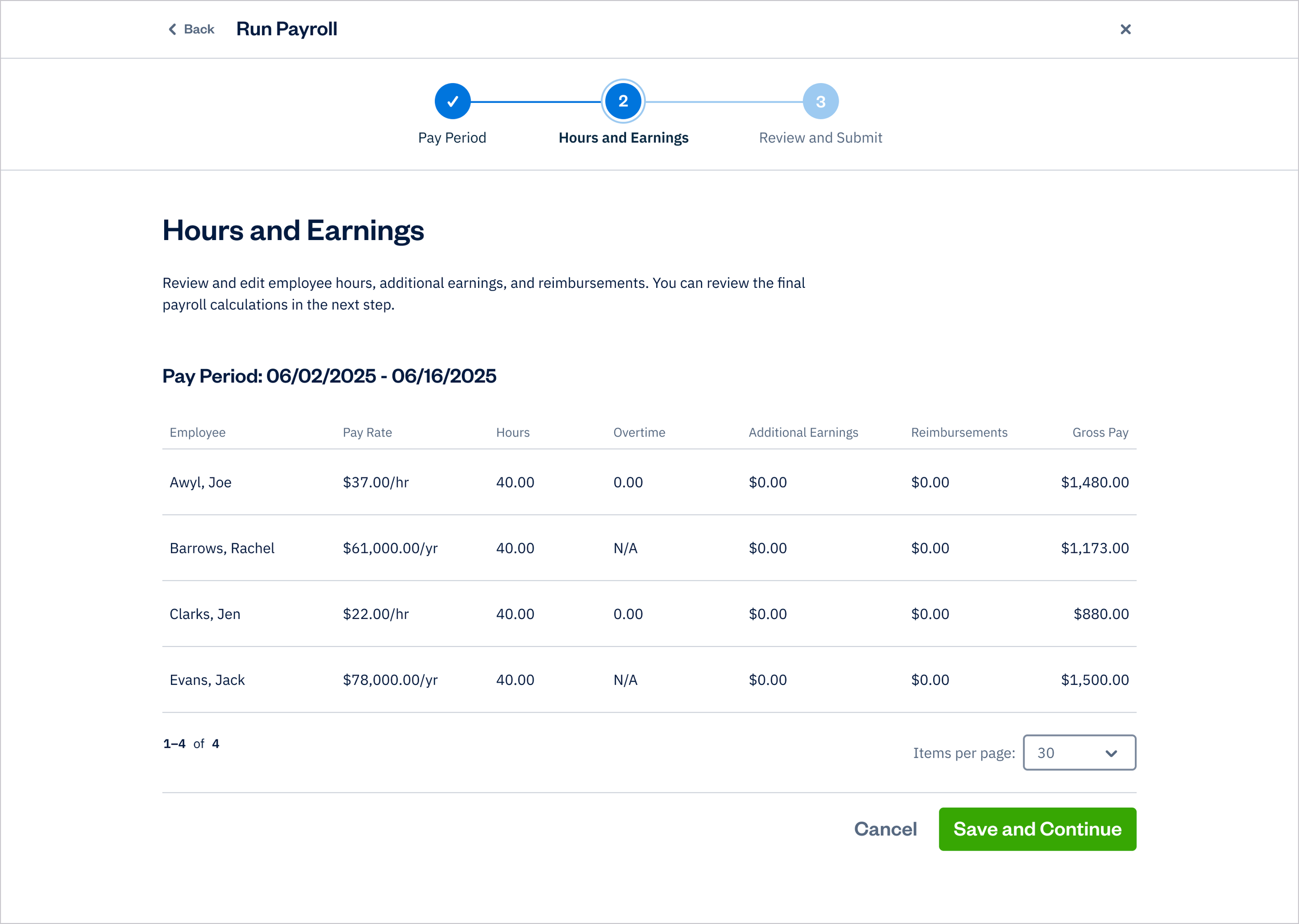

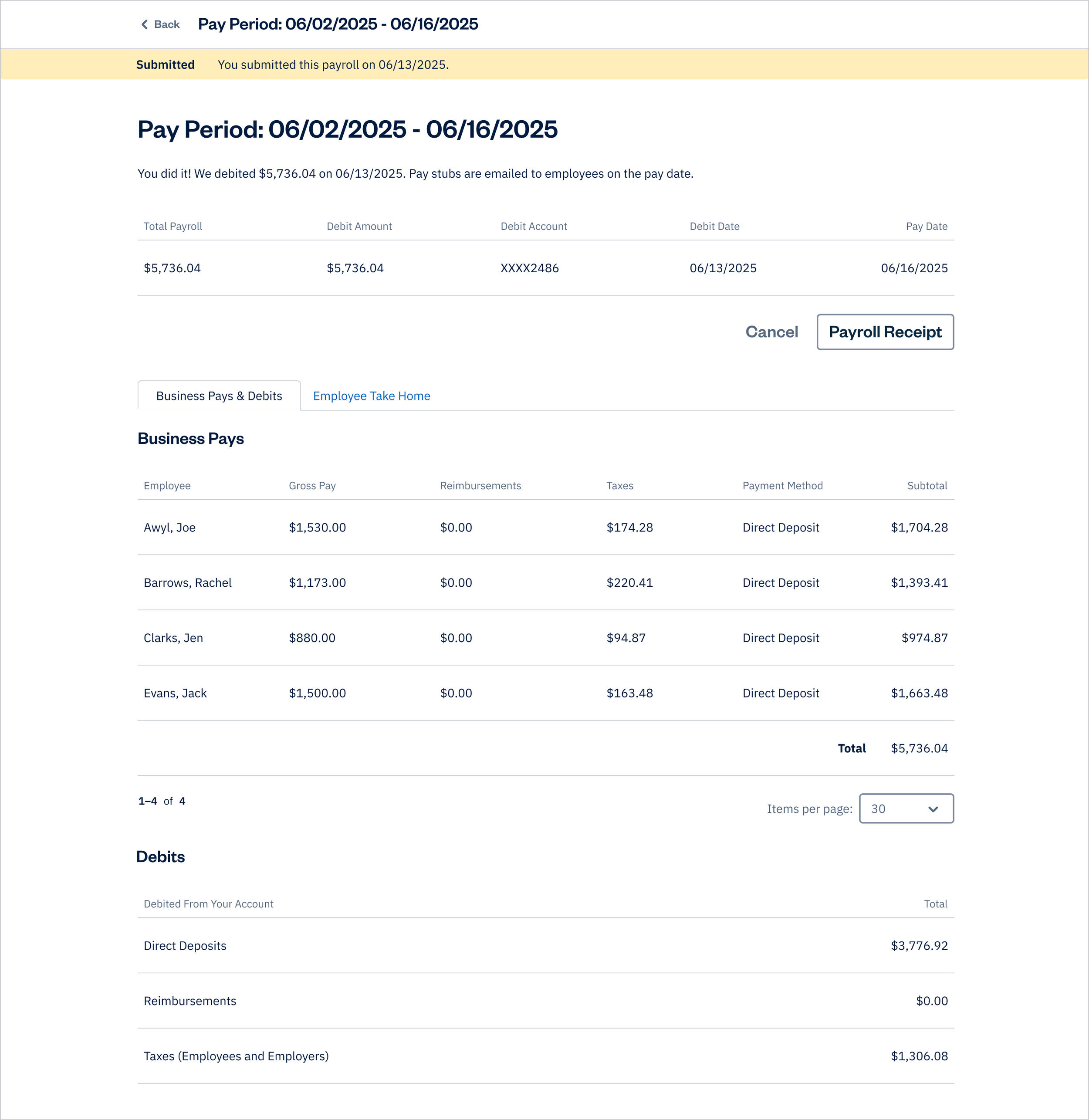

Run Payroll steps

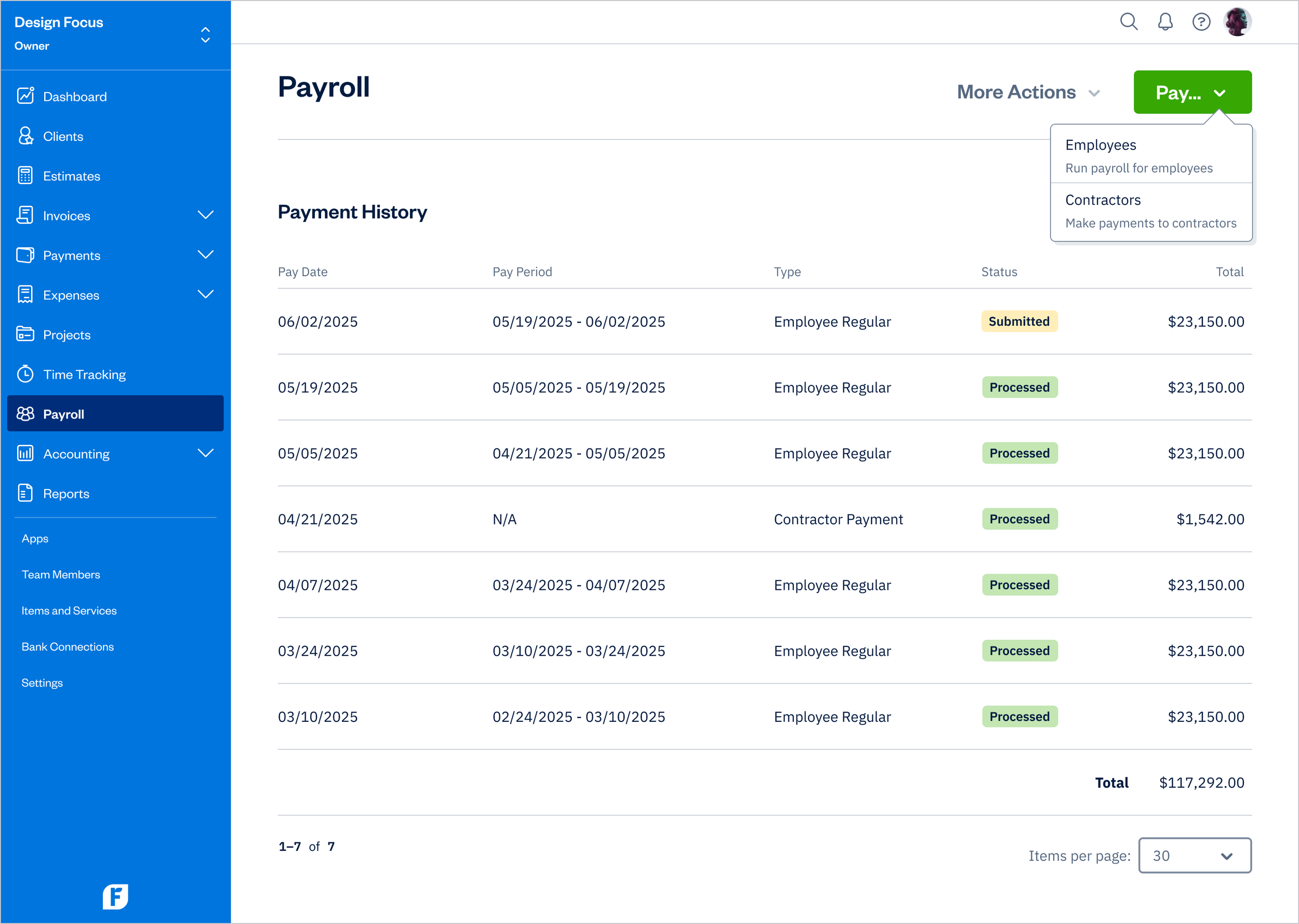

On the Payroll page, select Pay and choose Employees or Contractors

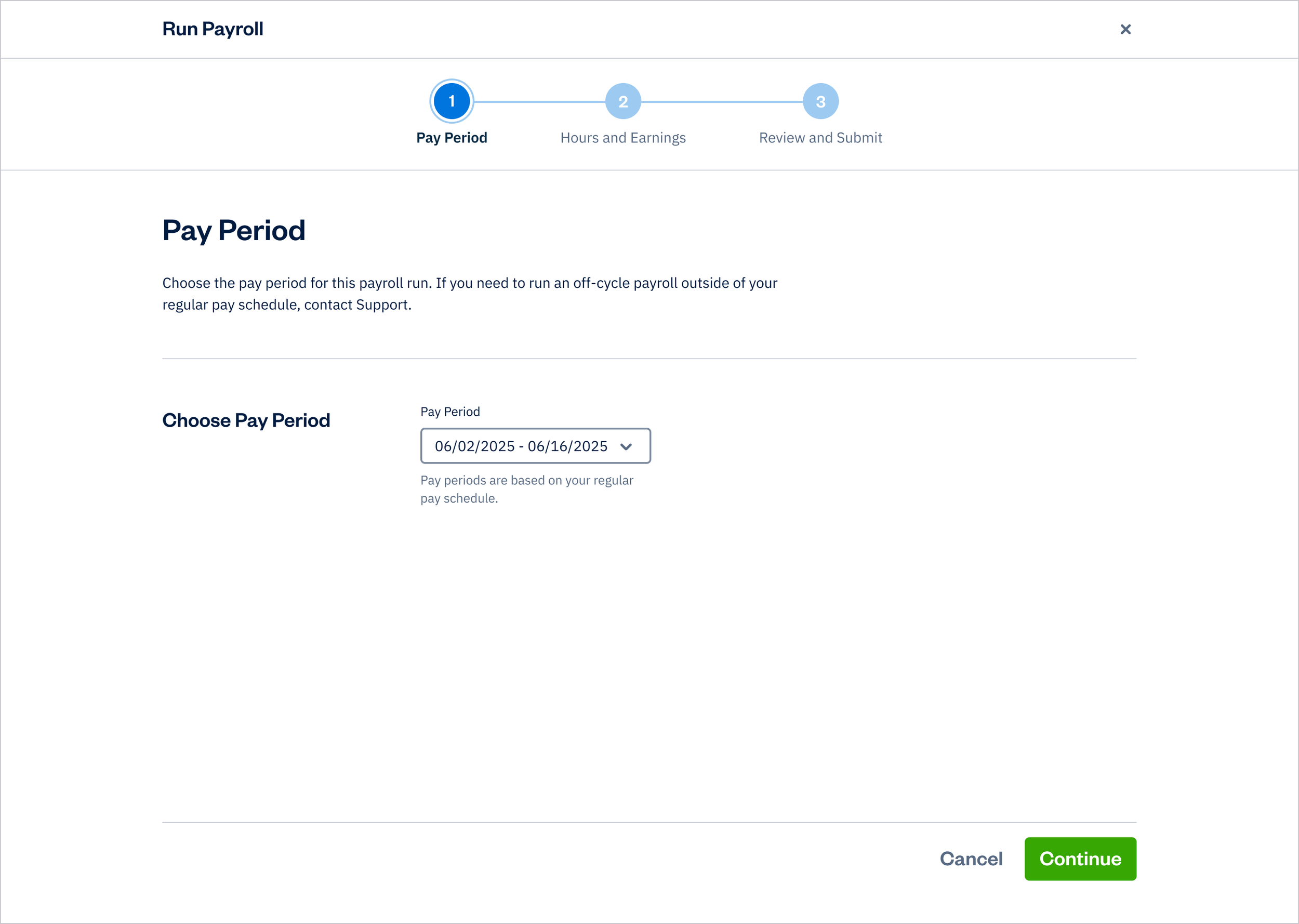

Select a Pay Period

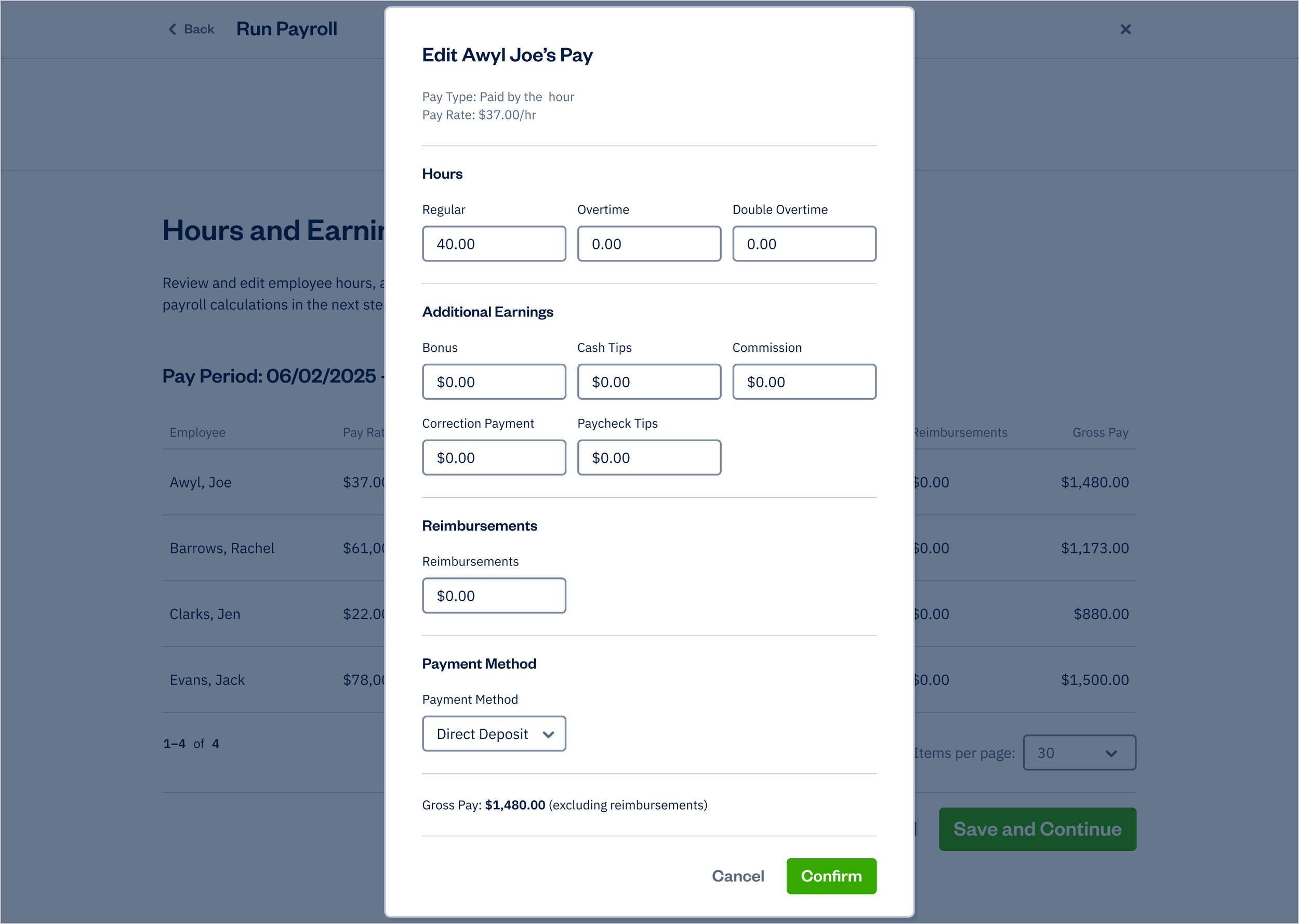

Hours and Earnings - edit employee details if needed

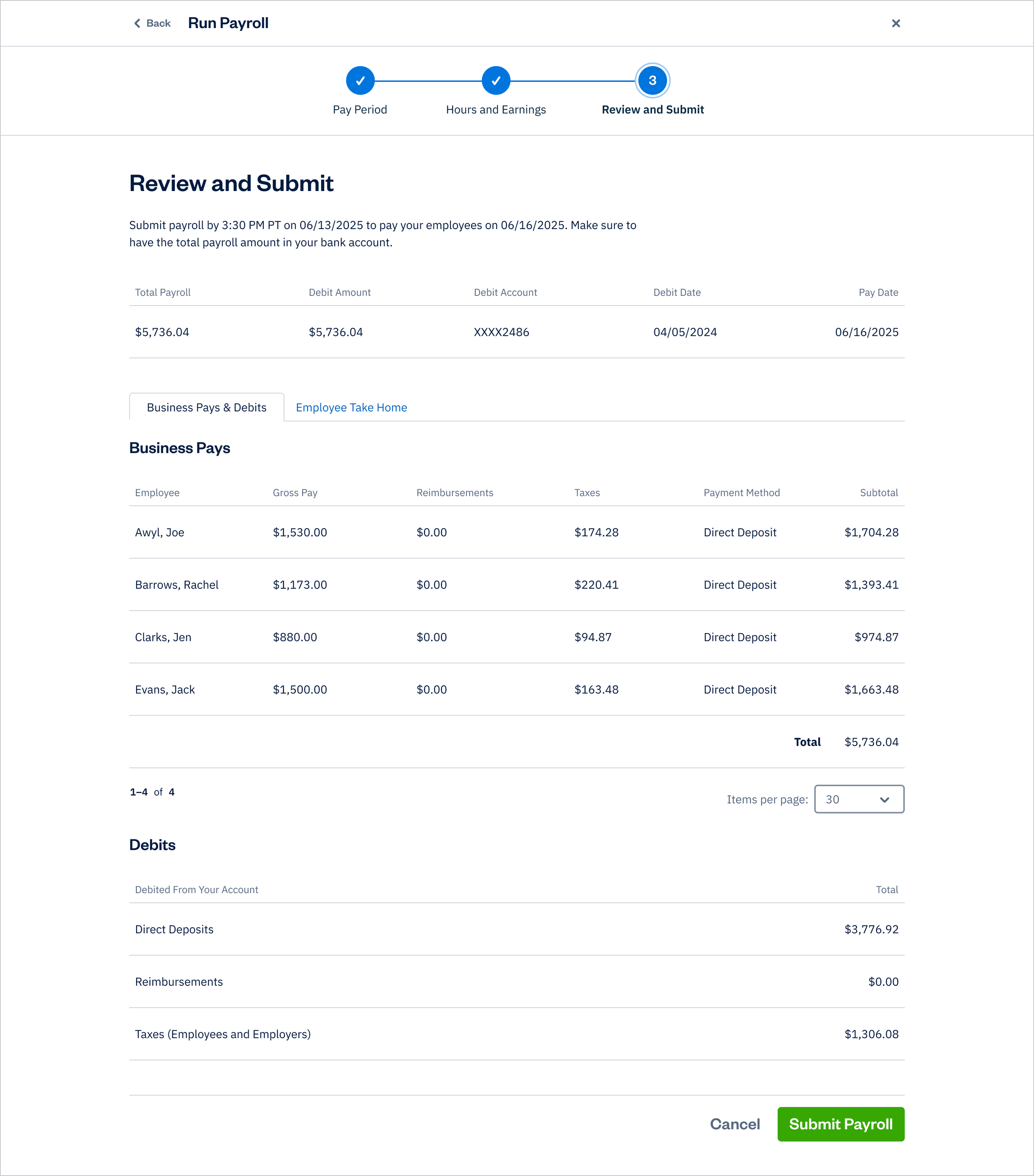

Review and Submit - review Business Pays, Employee Take Home, and Debits

Select Submit Payroll

DESIGN

Final design

After successful validation through user testing, I finalized designs for the Set Up flow, the Payroll page, the Run Payroll flow, and the Payroll Journal Report.

In the core Run Payroll flow, I minimized cognitive load and streamlined the process by using progressive disclosure and prepopulating key information (such as employees, pay rates, hours, taxes, and payment methods) based on setup data.

To see the design in a greater detail, you can view the prototype.

Note: the prototype has limited functionality.

Design system

I’ve improved the table component by introducing more columns to support the need for flexibility and surfacing more information. The result is a scalable component that is used on the Payroll page and throughout the Run Payroll flow.

Additionally, I’ve contributed to the iconography by designing feature-specific icons that help users identify actions and navigate the interface more intuitively.

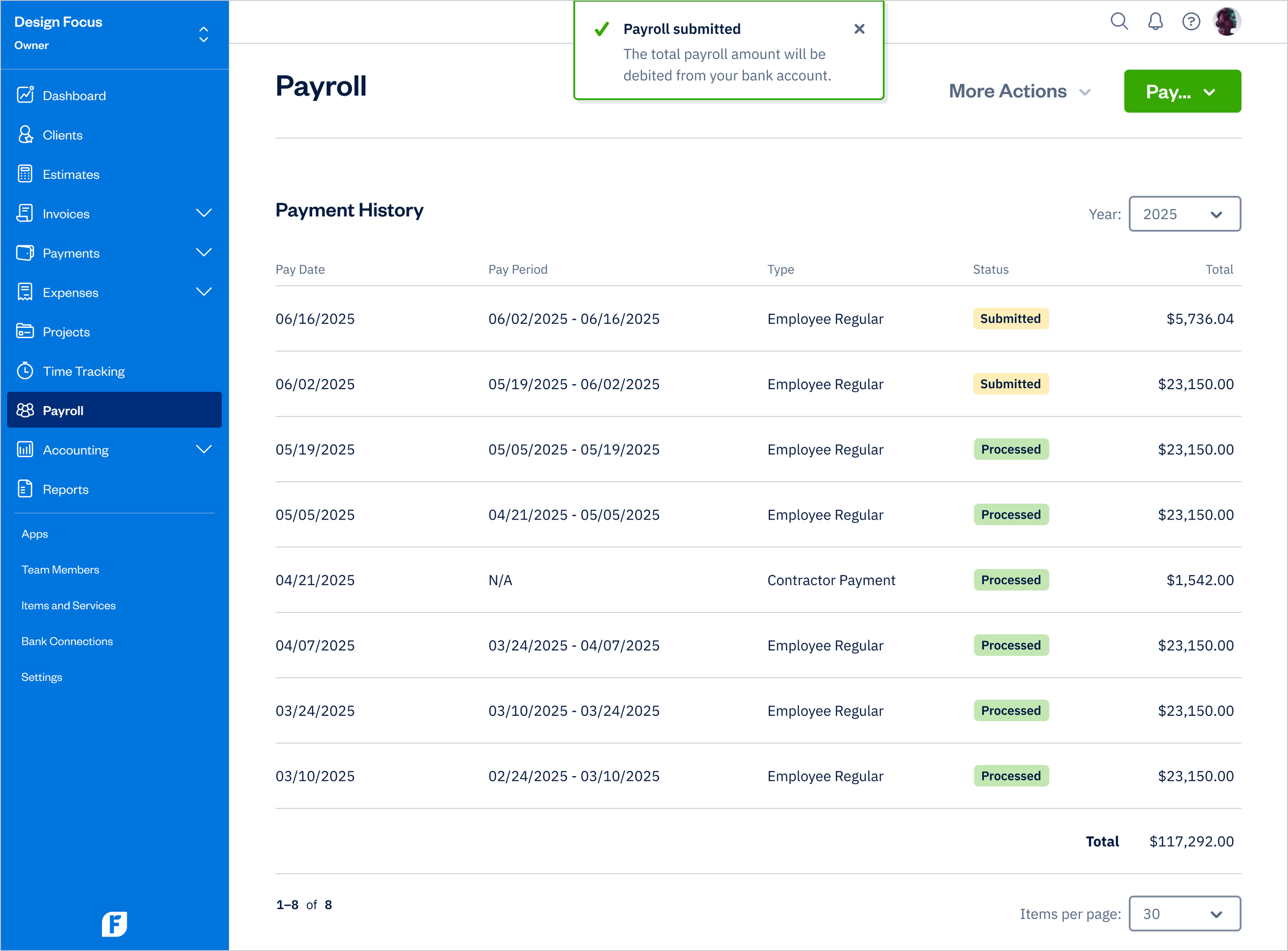

Accessibility

By pushing back on the use of a hover-based Quick Actions menu in the Payment History table that was initially considered (to access actions such as canceling a payroll run or downloading a payroll receipt), I ensured accessibility on touch devices like tablets and phones, where hover interactions aren’t supported.

Design principles

Unfold Like an Onion

Start as simple as possible, and gently reveal information only as it's needed. Where the choice presents itself, complexity should be opt-in. Customers can choose to turn on advanced options.

Adapt to the Task

Give frequent tasks priority and keep 'set-it-and-forget-it' tasks out of the way. Implement experiences that acknowledge different volumes; the needs of a customer with 10 Invoices are different than a customer with 1000, adapt the experience to suit each.

Maintain Flow

Surface only the options relevant to the task at hand. Enable customers to complete a workflow without leaving the page.

Speak Human

Be straightforward yet conversational, it shouldn't sound robotic or impersonal. Don't include jargon, or complicated phrasing. Where complicated terms are required (e.g., Accounting terminology), incorporate in-context help.

Set Expectations

Avoid surprises, customers should know what results will come out of their actions and feel in control. Provide customers with insight on where they are in the process and any effect on their clients before they take the action.

Don't Add, Evolve

Features should fit into the larger FreshBooks puzzle. Experiences should feel like a natural extension, increasing functionality instead of adding on top. Where a feature relates to another area of FreshBooks, the connection should be obvious.

Inclusive by Design

Bad design is disabling, good design enables. Build flexible experiences across design and code that meet diverse needs, validated through accessibility audits, testing with assistive technologies, and direct feedback from people with disabilities.

Challenges and trade-offs

Off-Cycle Payroll

To meet tight project timelines, we descoped Off-Cycle Payroll from the in-app experience. As a low-frequency workflow (~10% of payroll runs), we mitigated risk by supporting it through customer support and focused on shipping the Regular Payroll flow on time.

Table constraints

During usability testing of the Payroll page, research revealed that the legacy table component’s four-column limit no longer met user needs. Despite engineering concerns about grid constraints and delivery risk, I advocated for prioritizing validated user requirements over short-term implementation convenience.

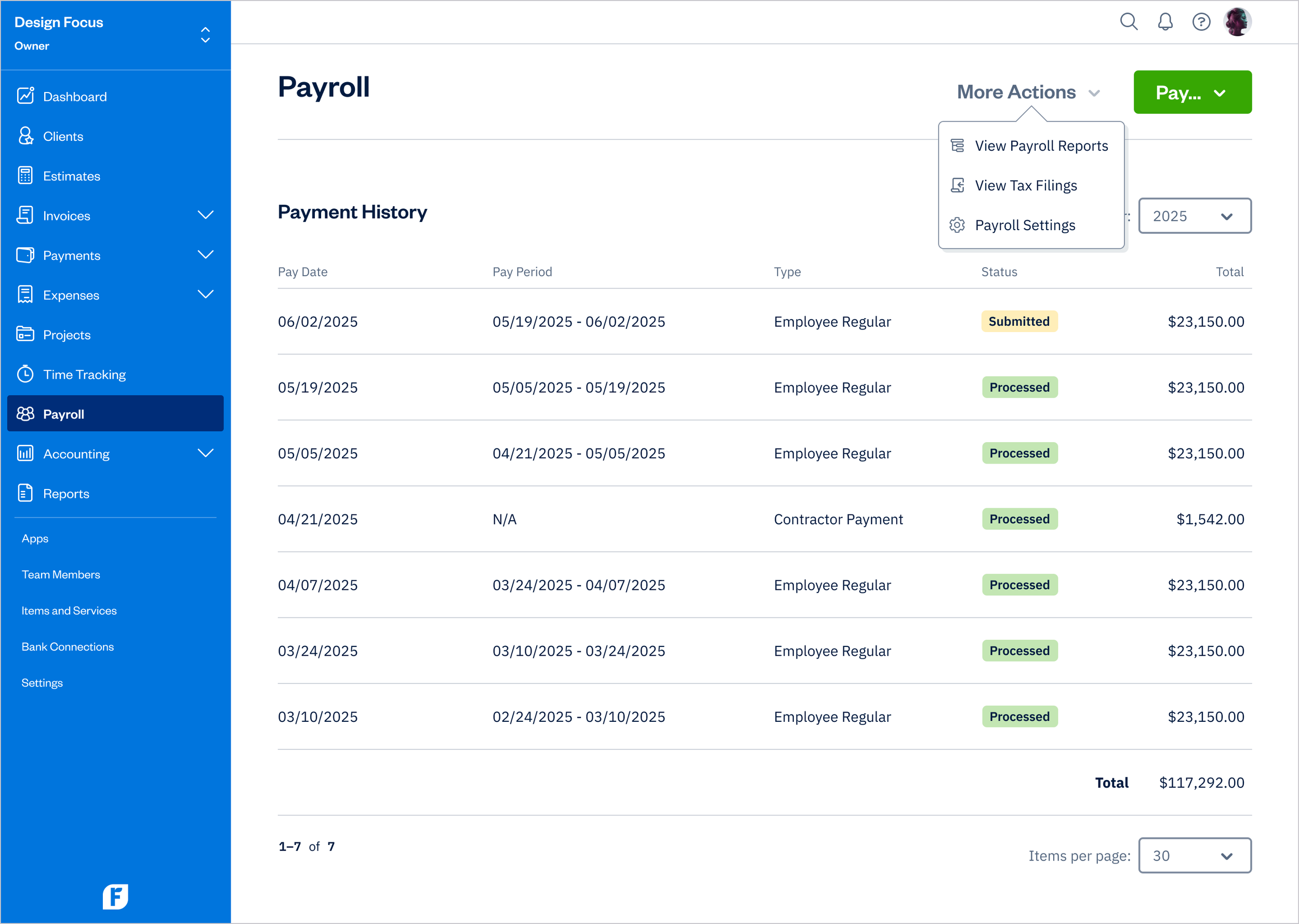

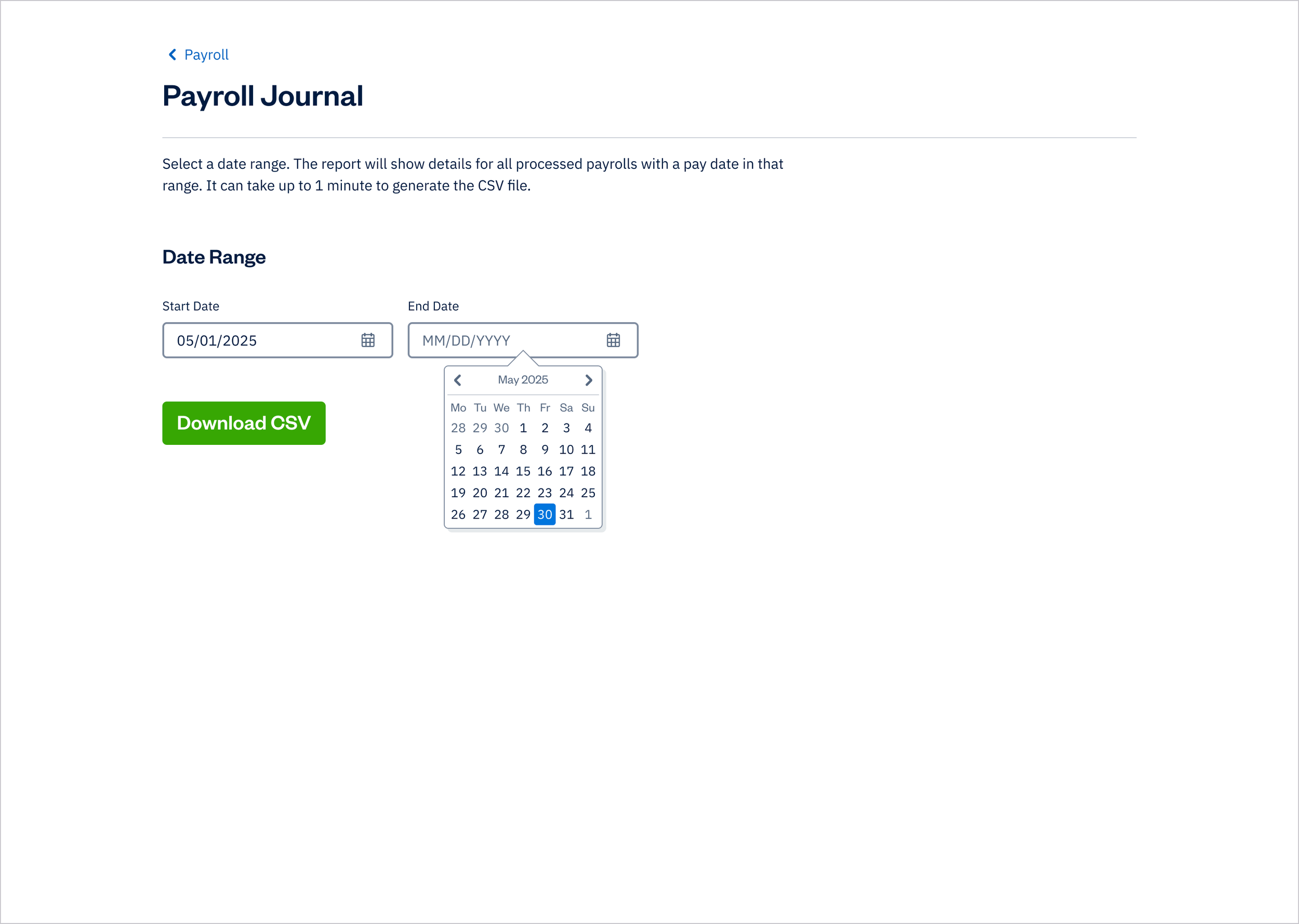

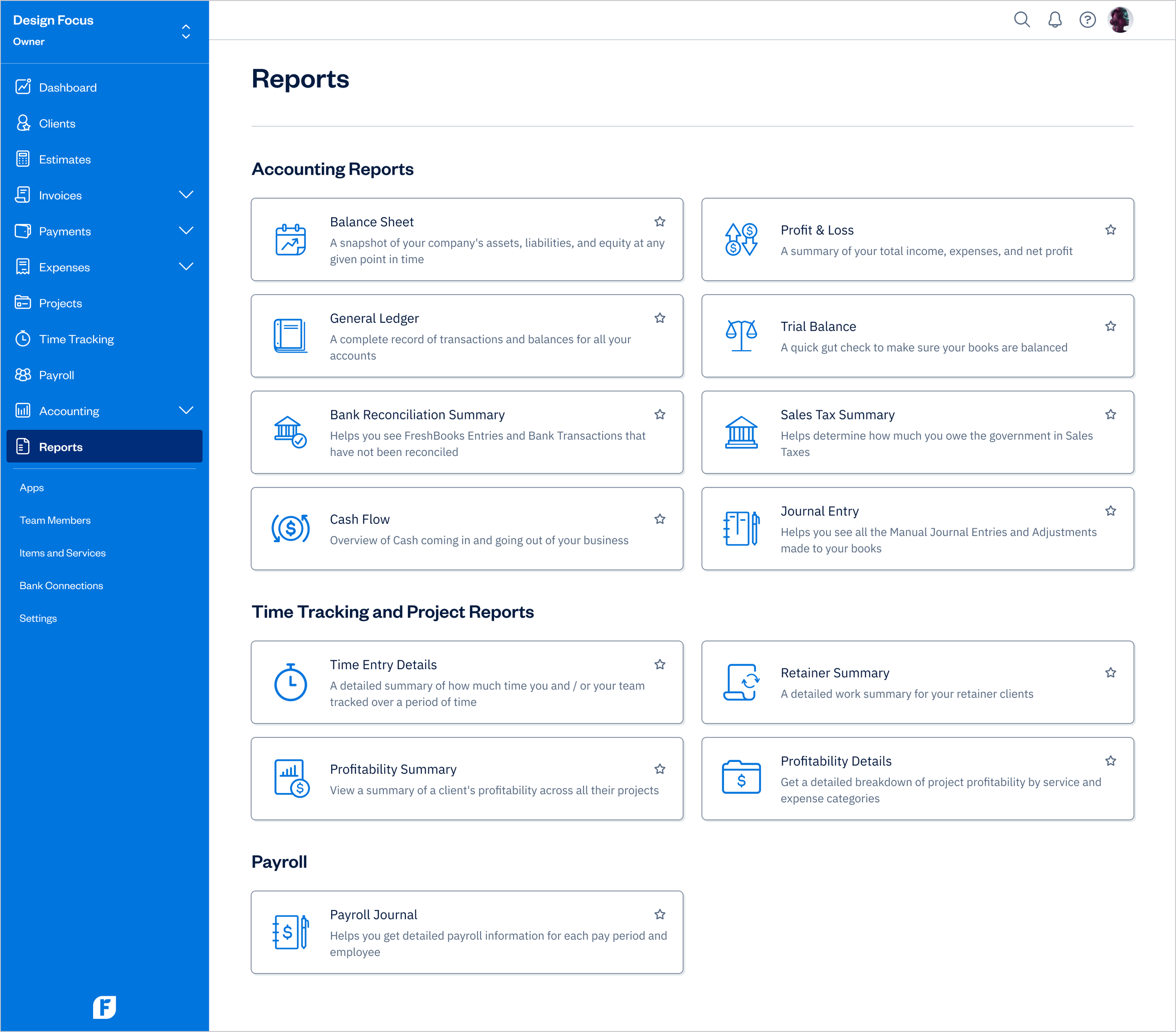

The images below show the Set Up flow, Payroll page, Run Payroll flow, and Payroll Journal Report.

Payroll

Payroll - Pay Dropdown

Run Payroll - Step 1: Pay Period

Run Payroll - Step 2: Hours and Earnings

Run Payroll - Step 2: Hours and Earnings - Edit Pay Modal

Run Payroll - Step 3: Review and Submit

Payroll - Submitted

Submitted Payroll Run

Payroll - More Actions Dropdown

Payroll Journal Report

Reports - Payroll Journal

IMPACT

KPIs

The new embedded Payroll solution drove measurable improvements across key metrics, as shown by quantitative results and qualitative user feedback.

40,000+

monthly active users

89%

adoption rate

92%

engagement rate

95%

retention rate

8%

churn rate

+47

net promoter score

How we measured success

Adoption rate (89%) was calculated as the percentage of users who have interacted with Payroll, out of the total number of users who have added Payroll to their subscription, since launch.

Engagement rate (92%) was calculated based on users who performed meaningful actions in Payroll, such as running payroll and payroll reports, per month.

Retention rate (95%) was calculated as the average percentage of users who continued to actively use Payroll month-over-month, based on usage data since launch.

Churn rate (8%), reduced from 25% pre-launch, was calculated as the percentage of users who stopped actively using Payroll month-over-month, based on usage data since launch. This significant decrease indicates high feature satisfaction and suggests that users find Payroll valuable and well-integrated into their workflow.

NPS (+47) was calculated using feedback gathered through surveys delivered in-app and via email. The majority of respondents gave a 9 or 10, praising the ease of use, speed, and reliability of the new payroll solution.

All usage-based metrics were tracked with Fullstory, and survey feedback was collected via Pendo.

Customer feedback

“FreshBooks Payroll has been a reliable, efficient and user friendly tool for managing my team's payroll. It simplifies the process, ensures compliance and integrates perfectly with my accounting system.”

Business Owner

PROJECT DETAILS

Project details

Role: Senior Product Designer, UX Researcher

Company: FreshBooks

Industry: Finance, SaaS

Market: B2B

Team: Product Designer, Product Manager, Engineering

Frameworks: Design Thinking, Agile

Tools:

Design: Figma, Zeroheight, Miro

User research: UserInterviews.com

Project management: Jira, Confluence

Product analytics: Fullstory, Pendo, Looker

Year: 2025

Platform: Web

Link: FreshBooks.com